Re: Mental Models - Valuation/Risk Drivers of Financial Assets As Partial Derivatives.

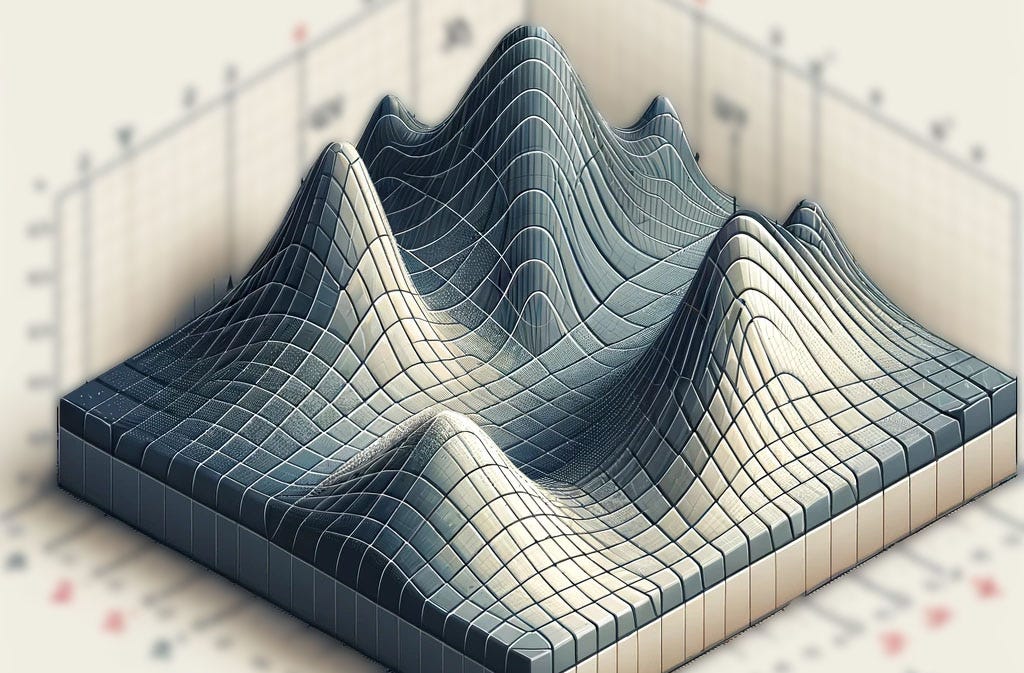

Don't let the title scare you. This Mental Model from Calculus is extremely powerful in understanding the Drivers for Valuation and Risk for ALL Financial Assets across the Capital Structure.

I know the title is scary, but if you bear with me, I think this is the most powerful Mental Model I’ve introduced yet, because it ties together so many equivalent concepts from not just different fields but different Asset Classes from within Finance/Economics.

But first, the motivation behind finding good Mental Models…