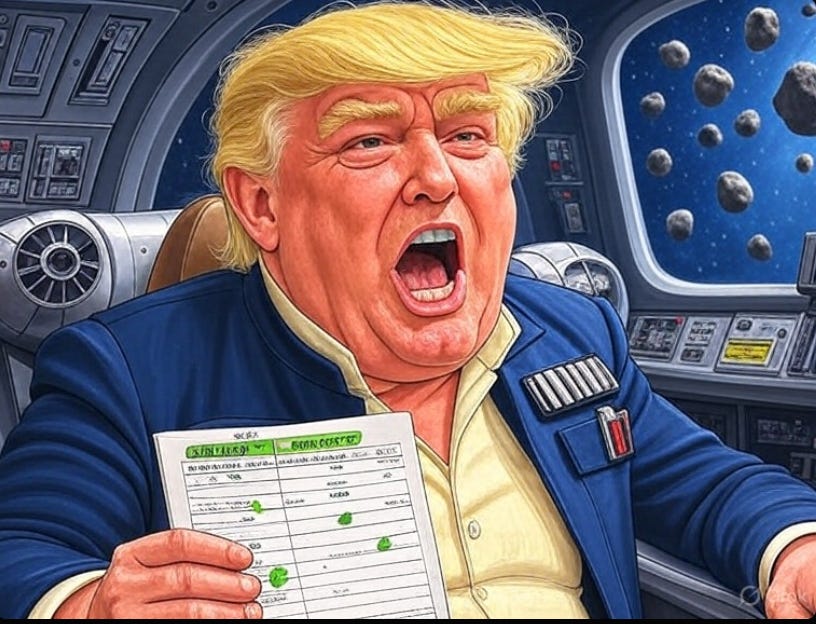

Re: Macro/Geopolitics-Where Are We In The Asteroid Field?

How is Trump 2.0 navigating the treacherous Asteroid Field? It's time for a report card.

Back in March, I wrote a detailed missive about how I saw the Trump 2.0 Policy Playbook shaping up:

To revisit the Star Wars analogy:

Trump 2.0 is piloting the Millennium Falcon (the US Economy and Credibility) through an Asteroid Field of difficult policy choices.