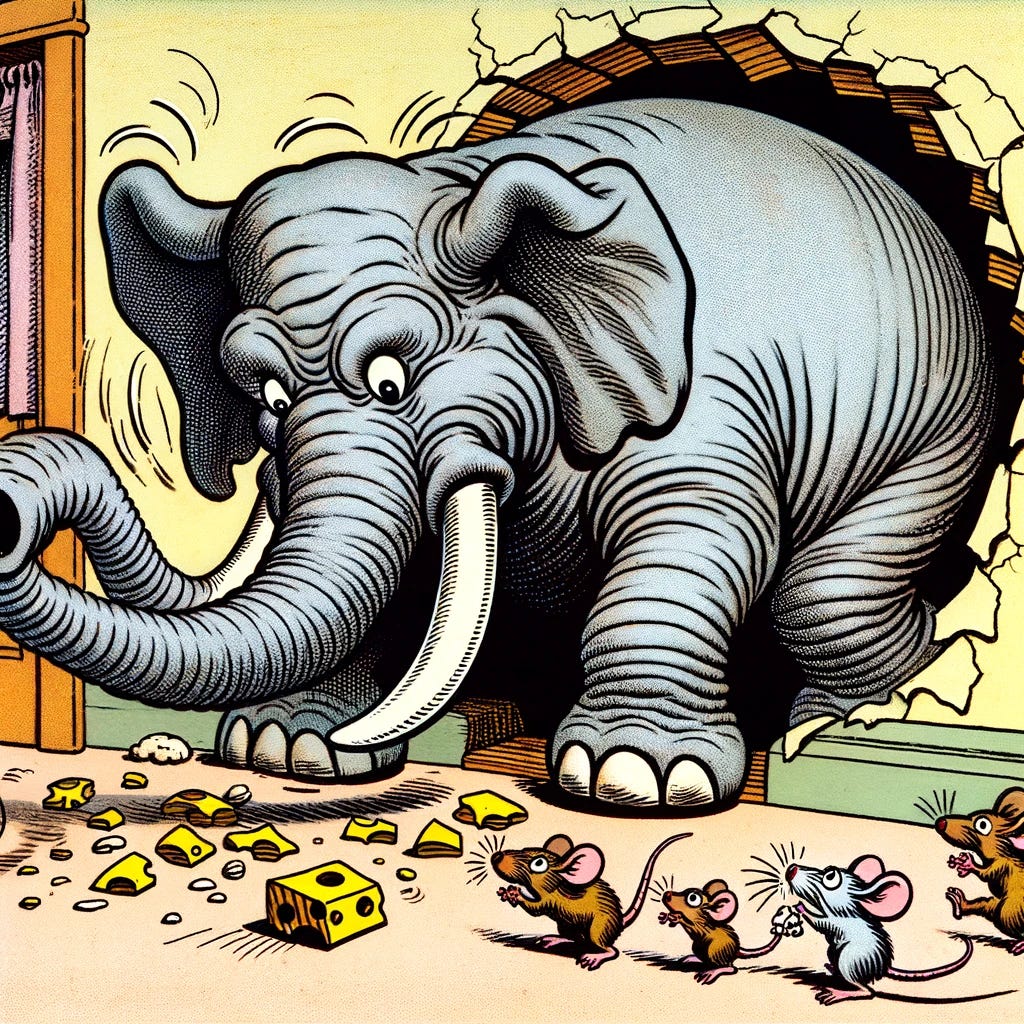

Re: Investing - Institutionalizing the "Elephant Through A Mousehole."

In 1999-2000, high-flying IPOs often floated tiny %'s of shares to create artificial Supply Inelasticity, which really exacerbated the up AND down crash. There are several parallels today.

Every cycle is different, so I don’t want to get too lost in the weeds in comparing present era market dynamics to the Dot Com Bubble in terms of valuations, prevalence of IPOs (or lack thereof), or the underlying Tech/Macro drivers. I also promise to not commit the heinous chart crime of overlaying one period of price action to another. To me, the dang…